New Study Says People Still Prefer Gas Cars Over Hybrids & EVs

Despite the advancements in electric and hybrid vehicle technology, a recent study reveals that traditional gas-powered cars remain the most popular choice among consumers. Even when considering equal costs and features across different powertrains, internal combustion engines (ICEs) continue to dominate the market.

Survey Results: Gas Engines Lead the Pack

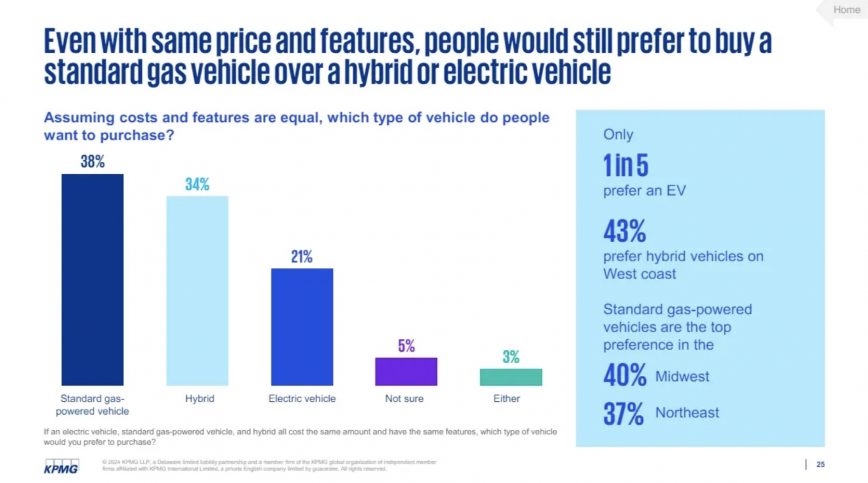

According to a survey conducted by KPMG, 38% of respondents expressed a preference for traditional gas engines when purchasing a vehicle. Hybrids were close behind, with 34% of the vote, while electric vehicles (EVs) garnered only 21% support. Five percent of those surveyed were undecided, and three percent were indifferent as long as they had a vehicle.

This survey, although limited to 1,100 participants and conducted in April, reflects a significant trend in consumer preferences. The survey sample, based on 2020 U.S. Census Bureau demographics, represents a microcosm of the broader market.

Consumer Preferences and Market Realities

The first quarter of the year witnessed concerns about declining EV sales, largely driven by fluctuations in Tesla’s performance. However, other automakers continued to perform well. This raises the question: are consumers genuinely interested in EVs, or are they simply buying what’s available?

Several years ago, major automakers announced ambitious plans to transition to fully electric lineups by 2030, 2035, or even 2040. Fast forward to today, and companies like GM and Ford are reintroducing hybrids into their product lines. Meanwhile, Toyota, Mazda, and Subaru are collaboratively developing a new internal combustion engine, indicating a sustained interest in traditional powertrains.

Regional Differences in Car Preferences

The KPMG study highlights a geographical divide in vehicle preferences. On the West Coast, there is a higher inclination towards EVs and hybrids. Conversely, in the Midwest and Northeast, standard gas-only cars remain the top choice, with 40% and 37% of the votes, respectively.

The Charging Challenge

One significant barrier to EV adoption is charging infrastructure. Sixty percent of survey respondents indicated they would wait no more than 20 minutes for an 80% charge. However, only 41% of automotive executives shared this sentiment. Ford CEO Jim Farley, for example, has openly acknowledged the challenges of EV charging, notably during his Route 66 road trip in an F-150 Lightning.

Understanding the Energy Transition

KPMG U.S. Energy Sector Leader Angie Gildea explains that consumers are currently more comfortable with familiar technologies, which include both renewables and fossil fuels. This preference underscores the complexities of the ongoing energy transition. Gildea emphasizes the need for consumer education and cost reductions to facilitate broader EV adoption.

Financial Incentives and Affordability

Despite the growing interest in electrified vehicles, their higher cost remains a significant barrier. Without the $7,500 federal tax credit and other local incentives, many consumers find EVs financially out of reach. These incentives play a crucial role in making EVs a viable option for a broader audience.

Bridging the Gap

The KPMG study sheds light on the disconnect between consumer preferences and the offerings of automakers. While there is a clear interest in hybrids and EVs, traditional gas-powered vehicles still hold a substantial share of the market. This reality calls for a balanced approach in the automotive industry, combining the development of new technologies with efforts to address consumer concerns and preferences.

As the market evolves, both auto executives and policymakers must consider these findings to navigate the transition towards more sustainable transportation options effectively. Engaging with consumers, addressing their concerns, and providing practical solutions will be crucial in shaping the future of the automotive industry.